The final stage in a business transaction is to send an invoice and receive payment of the amount owing for goods supplied or services rendered. In some business transactions, like wholesale and foreign trade, it is customary to allow credit.

Invoices and adjustments

When goods are supplied on credit, the supplier sends an invoice to the buyer to:

- inform the buyer of the amount due

- enable the buyer to check the goods delivered

- enable entry in the buyer’s purchases day book.

Invoices are sometimes sent with the goods, but they are more usually mailed separately. If the buyer is not a regular customer, they may be expected to settle the account immediately. Regular customers will be given credit, with invoices being charged to their accounts. Payment will then be made later on the basis of a statement of account sent by the supplier monthly or at other periodic intervals.

Invoice

VAT: Value Added Tax. A tax on goods and services, payable to HM Customs and Excise.

E &: Errors and omissions excepted. This statement reserves the supplier’s right to correct any

OE: errors which the document may contain.

Pro forma invoices

When should you send a proforma invoice?

There are two main reasons why your business may need to create a provisional bill of sale in advance of the actual sale. Either you want to declare an estimate of the final cost of the item or service you’re providing, or you want to ship internationally.

Cost estimate

Proforma invoices serve as a sort of good faith agreement between you and your customer.

They are a baseline for a sale, a breakdown of the items with an accurate indication of the total amount due – but you are not requesting payment.

This makes a proforma invoice the ideal option when a sale hasn’t yet been finalised or the goods or services are still under negotiation, as you’re providing a format that can later be adjusted if necessary.

International shipping

Since they often include details about shipping, packaging, weight, and delivery fees, proforma invoices are often used in the international shipping industry. They help to declare the value of an item so that it can pass through customs quickly and be delivered to your customer on time.

Covering letter (L/C) with Invoice:

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. It may be offered as a facility.

Due to the nature of international dealings, including factors such as distance, differing laws in each country, and difficulty in knowing each party personally, the use of letters of credit has become a very important aspect of international trade.

Non-regular customer

Dear Mr Timms

We attach our invoice number B 832 for the polyester shirts ordered on 13 August.

The goods are available from stock and will be sent to you as soon as we receive the amount shown on the attached invoice, namely £1,342.78.

I hope to hear from you soon.

Regular customer

Dear John

Our invoice number B 832 is attached covering the polyester shirts you ordered on 13 August.

These shirts have been packed ready for despatch and are being sent to you, carriage paid, by rail. They should reach you within a few days.

All the best

Mark Robinson

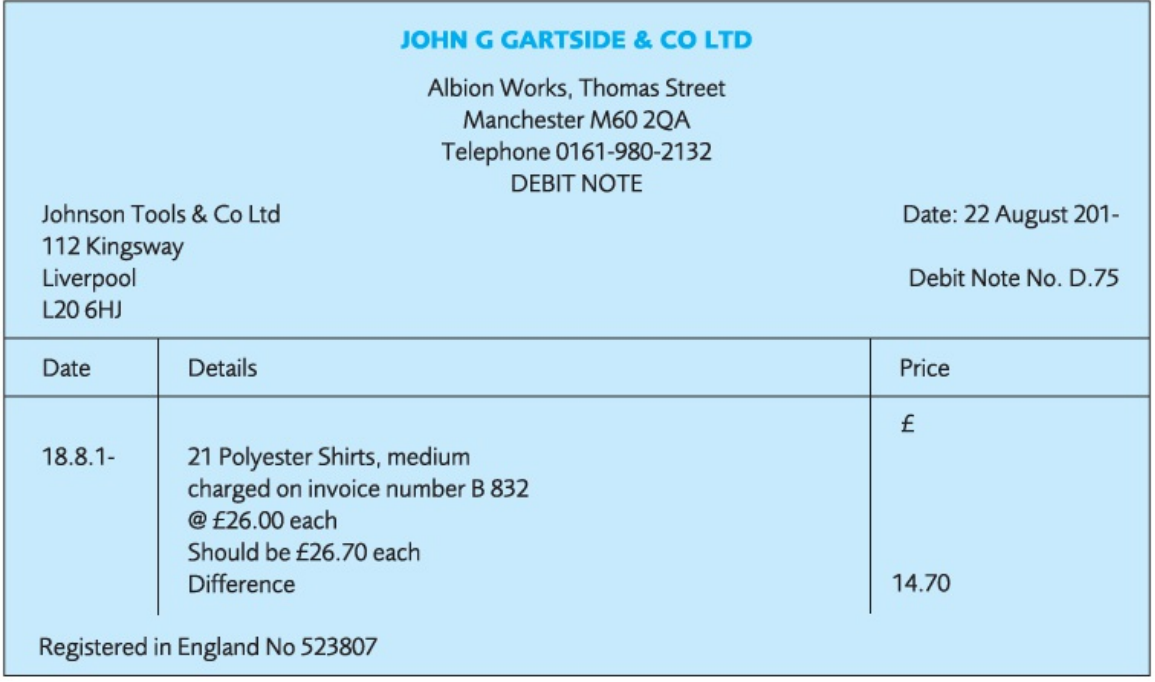

Debit and credit notes

Debit and credit notes

Supplier sends debit note

Dear Mr Lim

I am sorry that an error was made on our invoice number B 832 of 18 August.

The correct charge for polyester shirts, medium, is £26.70 and not £26.00 as stated. We are therefore enclosing a debit note for the amount undercharged, namely £14.70.

We are sorry this error was not noticed before the invoice was sent.

Yours faithfully

A debit note is sent by the supplier to a buyer who has been undercharged in the original invoice.

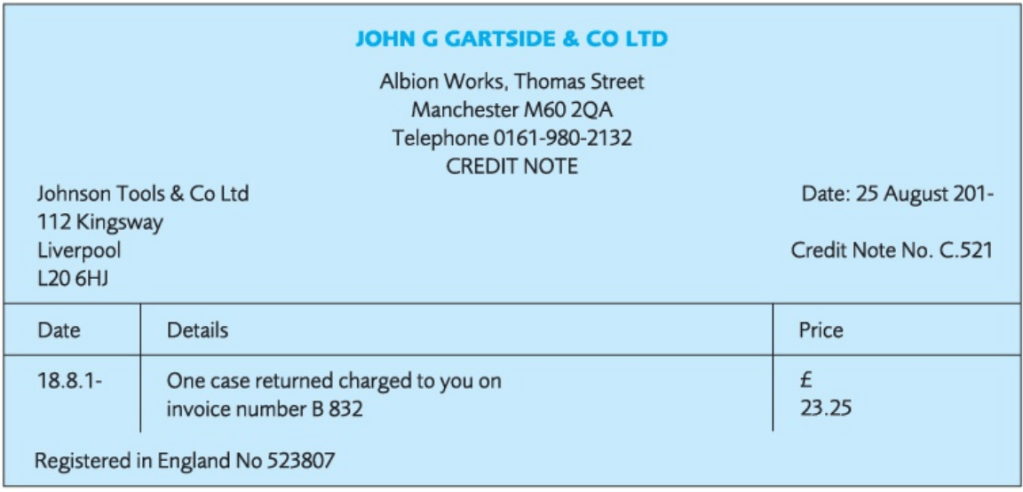

Buyer requests credit note

Returned packing case

Dear Sirs

We have today returned to you by rail one empty packing case, charged on your invoice number B 832 of 18 August at £23.25.

A debit note for this amount is enclosed and we shall be glad to receive your credit note in return.

Yours faithfully

Incorrect trade discount

Dear Sir

Your invoice number 2370 dated 10 September allows a trade discount of only 33.3% instead of 40% as agreed in your letter dated 5 August in view of the unusually large order.

When calculated on the invoice gross total of £1,500, the difference in discount is exactly £100. Can you please adjust your charge and then we will pass the invoice for immediate payment.

Yours faithfully

A credit note is sent by the supplier to a buyer who has been overcharged in the original invoice, or to acknowledge and allow credit for goods returned by the buyer. It is usually printed in red.

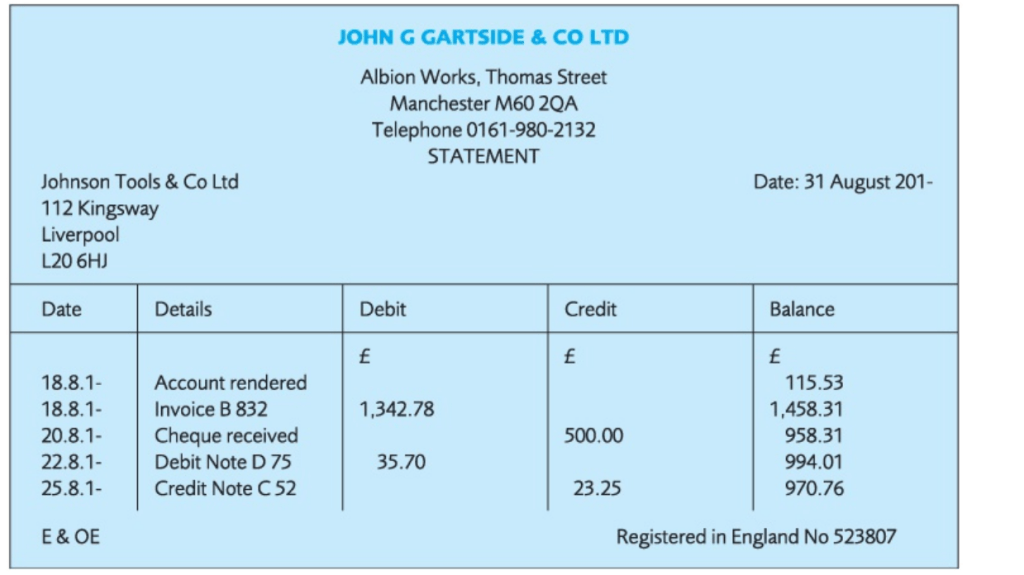

Statements of account

A statement is a summary of the transactions between buyer and supplier during a specified period, usually one month. It starts with the balance owing at the beginning of the period, if any. Amounts of invoices and debit notes issued are then listed, in chronological order, and amounts of any credit notes issued and payments made by the buyer are deducted. The closing balance shows the amount owing at the date of the statement.

Statements, like invoices, are generally sent without a covering letter. If a covering letter is sent, it need only be very short and formal.

A statement is a demand for payment sent at regular periods by the supplier to buyers. It summarises all transactions over the period it covers and enables the buyer to check against the particulars given.

Any errors discovered and agreed will be adjusted either by debit or credit note. Do check in your own country as to the minimum requirements for what to do if goods are faulty, and for returns and exchanges.

Supplier reports underpaid statement

Supplier’s letter

Dear Sirs

We are enclosing our September statement totalling £820.57.

The opening balance brought forward is the amount left uncovered by the cheque received from you against our August statement, which totalled £560.27. The cheque received from you, however, was drawn for £500.27 only, leaving the unpaid balance of £60 brought forward.

We look forward to receiving early settlement of the total amount now due.

Yours faithfully

Buyer’s reply

Dear Sirs

We have received your letter of 15 October enclosing September’s statement.

We apologise for the underpayment of £60 on your August statement. This was due to a misreading of the amount due. The final figure was not very clearly printed and we mistakenly read it as £500.27 instead of £560.27.

Our cheque for £820.57, the total amount on the September statement, is enclosed.

Yours faithfully

Buyer reports errors in statement

Buyer’s notification

Dear Sirs

On checking your statement for July we notice the following errors:

- The sum of £14.10 for the return of empty packing cases, covered by your credit note number 621 dated 5 July, has not been entered.

- Invoice Number W825 for £127.32 has been debited twice – once on 11 July and again on 21 July.

Therefore, we have deducted the sum of £141.42 from the balance shown on your statement. Our cheque for £354.50 is attached in full settlement.

Yours faithfully

Supplier’s acknowledgement

Dear Sirs

Thank you for your letter of 10 August enclosing your cheque for £354.50 in full settlement of the amount due against our July statement.

Our apologies for the inconvenience.

Yours faithfully

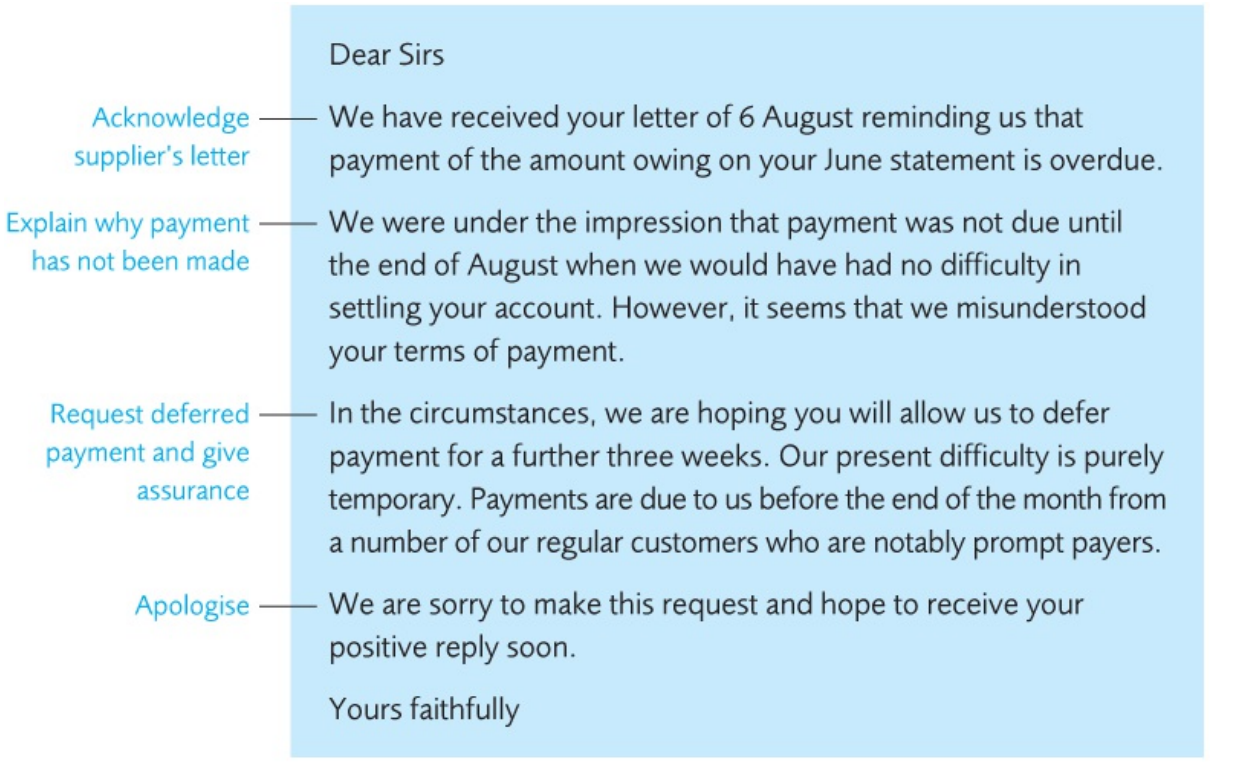

Varying the terms of payment

When a customer is required to pay for goods when, or before, they are delivered, he is said to pay ‘on invoice’. Customers known to be creditworthy may be granted ‘open account’ terms, under which invoices are charged to their accounts. Settlement is then made on the basis of statements of account sent by the supplier.

When a customer finds it necessary to ask for time to pay, the reasons given must be strong enough to convince the supplier that the difficulties are purely temporary and that payment will be made later.

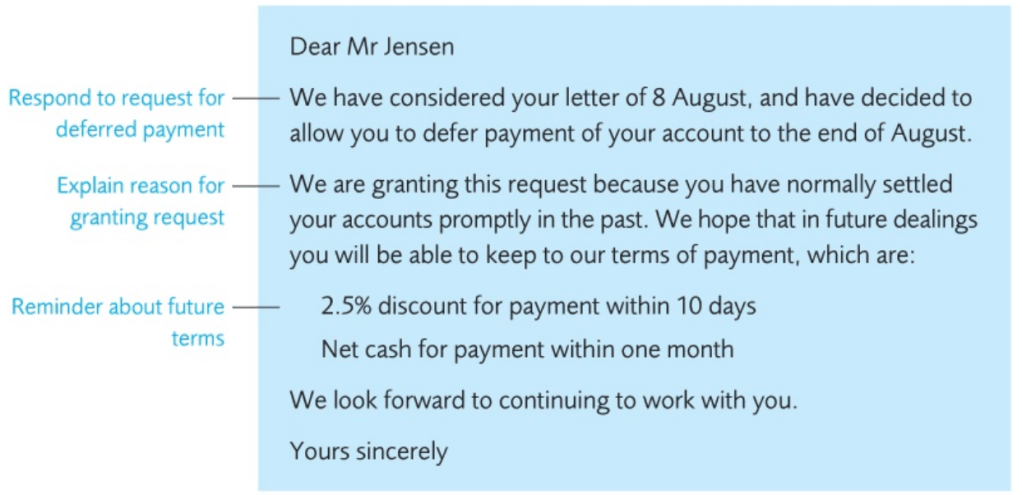

Customer requests time to pay (granted)

Customer’s request

Supplier’s reply

Net cash is a financial figure that is derived by subtracting a company’s total liabilities from its total cash.

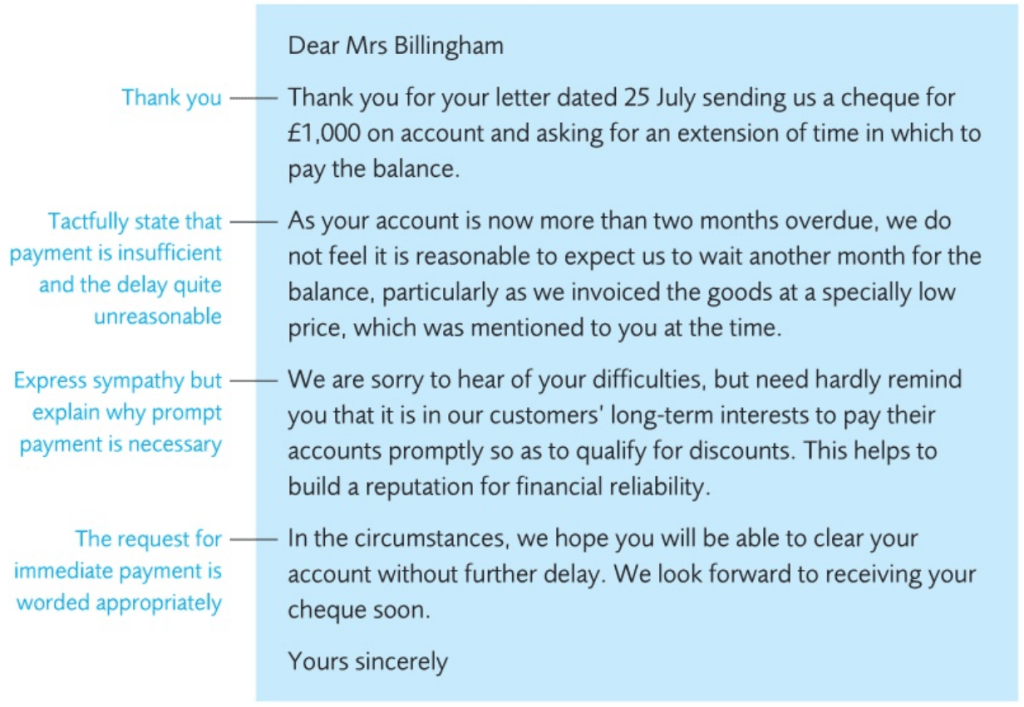

Customer requests time to pay (not granted)

Customer’s request

Dear Mr Wilson

Thank you for your letter dated 23 July asking for immediate payment of the £1,987 due on your invoice number AV54.

When we wrote promising to pay you in full by 16 July, we fully expected to be able to do so. However, we were called upon to meet an unforeseen and unusually heavy demand earlier this month.

We are enclosing a cheque for £1,000 on account, and hope you will allow us a further few weeks in which to settle the balance. We fully expect to be able to settle your account in full by the end of August.

I hope to hear from you soon.

Yours sincerely

heavy demand: to require use of a large amount of (energy, time, resources, etc.)

Supplier’s reply

In refusing requests of this kind it is better for suppliers to stress the benefits the customer is likely to gain from making payments promptly rather than to stress their own difficulties in seeking prompt payment. The customer is, after all, more interested in problems closer to home.

Supplier questions partial payment

“On account” is an accounting term that denotes partial payment of an amount owed. On account can also be referred to as “on credit.”

Dear

Thank you for your letter dated 10 October enclosing your cheque for £58.67. Our official receipt is enclosed as requested.

As you do not say that the cheque is on account, we are wondering if this amount was intended to be £88.67 – this is the balance on your account as shown in our September statement.

We look forward to receiving the uncleared balance of £30 within the next few days.

Yours sincerely

Supplier rejects discount deduction

Dear

Thank you for your letter dated 15 October stating that your cheque for £282.50 is in full settlement of your May statement.

Unfortunately, we cannot accept this payment as full payment of the £300 due on our statement. The terms of payment allow the 2.5% cash discount only on accounts paid within 10 days of the statement, but your recent payment is more than a month overdue.

The balance still owing is £17.50 and to save you the trouble of making a separate payment we will include this amount in your next statement.

Yours sincerely

obsolete: no longer produced or used; out of date.

Supplier asks customer to select terms of payment

Dear

Thank you for your letter of 3 April, but you do not say whether you wish this transaction to be for cash or on credit.

When we wrote to you on 20 March we explained our willingness to offer easy credit terms to customers who do not wish to pay cash, and also that we allow generous discounts to cash customers.

We may not have made it clear that when placing orders customers should state whether cash or credit terms are required.

Please let me know which you prefer so that we can set up your account accordingly.

Yours sincerely

Form letter enclosing payment (and acknowledgement)

Sender’s form letter

Dear Sirs

We have pleasure in enclosing our cheque (bill/draft/etc) for £_______ in full settlement (part settlement) of your statement (invoice) dated.

Please send us your official receipt.

Yours faithfully

Form letter acknowledging payment

Dear

Thank you for your letter of _______ enclosing cheque (bill/draft/etc) for £_______in full settlement (part payment) of our statement of account (invoice) dated _______.

We enclose our official receipt.

Yours sincerely

Letter informing supplier of payment by credit transfer

Dear Sirs

YOUR INVOICE NUMBER 1524

We have today made a credit transfer to your account at the Barminster Bank, Church Street, Dover, in payment of the amount due for the goods supplied on 2 May.

Yours faithfully

Letter informing supplier of payment by banker’s draft

Dear Sirs

Our banker’s draft is enclosed, drawn on the Midminster Bank, Benghazi, for £2,672.72 and crossed ‘Account Payee only’.

The draft is sent in full settlement of your account dated 31 May.

Please acknowledge receipt.

Yours faithfully

Leave a comment